Being insured is one of the best investments that business owners and working individuals can make. Why not? Availing insurance from reputable companies serves as protection against losses and damages caused by natural disasters and fortuitous events. Dealing with losses and damages can be financially exhausting if you don’t have a strong and comprehensive insurance policy to back you up.

Fortunately, getting insured nowadays is more convenient and affordable. Clients can skip the long queues needed to review, investigate, adjust, and remit their claims, and business operations will be highly optimized. With the help of insurance claims outsourcing, insurance companies and their clients are enjoying quicker and more efficient claims processing and billing. Continue reading to learn more about the benefits of outsourcing insurance claims in improving customer service and expediting every business function.

What is an insurance claim?

It is a formal request to your insurance provider for reimbursement of losses or damages covered under your policy. Types of claims depend on the property, business, or individual involved and covered by a specific policy. Insurance is often paid through fixed premium rates for vehicles, equipment, and medical and hospital bills.

What are the steps in insurance claims processing?

Like any business process, processing teams and claims departments in insurance companies follow necessary steps and perform processing tasks that require certain levels of meticulousness and accuracy. Here is the standard 5-step insurance claims process:

- The client establishes a connection with its broker.

- Claim adjusters thoroughly examine and evaluate insurance claims.

- Claims adjusters meticulously examine insurance policies.

- Claims team evaluate the damage and losses that are covered.

- Payment is arranged.

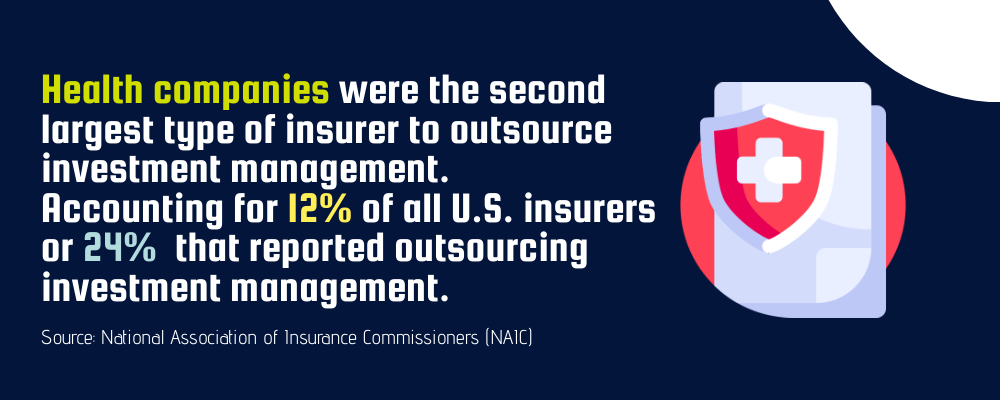

How big is the global insurance BPO market?

The Insurance Business Process Outsourcing market was valued at USD 6.15 Billion in 2024. With positive market changes that can boost profitability, the global insurance BPO market is expected to grow even bigger, reaching USD 8.55 Billion by 2031, with a compound annual growth rate (CAGR) of 4.20% from 2024 to 2031.

How does insurance claims outsourcing work?

Outsourcing insurance claims processes is done by contacting a third-party provider offering outsourcing services for various functions. Back-office and administrative functions are usually performed by experienced professionals to ensure that all outputs are of top quality and accuracy.

The purpose of outsourcing insurance claims processes is to help in-house claims handling teams avoid the arduous task of coordinating with different clients about different concerns for every business operation. By doing so, companies can provide a better customer experience while also focusing on their core business activities. Insurance companies may choose between these two outsourcing types according to the location of their third-party administrators (TPA):

- Onshore Outsourcing – involves contacting a service provider located in the same country. state, or city. This type of insurance outsourcing is often preferred by first-time outsourcers, since it offers lower risks and better control and monitoring opportunities to insurance companies.

- Offshore Outsourcing – unlike onshore outsourcing, offshoring happens when a BPO provider is located in a different country. For example, an insurance company based in the U.S. outsources its claims processing to the Philippines.

What claims handling tasks can be outsourced?

If you own an active insurance company, you can coordinate with your outsourcing partner about the tasks that your in-house team can entrust to them. Insurance outsourcing partners hire top insurance brokers, adjusters, claims professionals, and analysts with strong expertise to help process various types of claims, including complex ones.

Below are just a few of the important claims processing tasks that you can outsource:

- Reviewing specific claims

- Information collection and verification

- Claim forms preparation

- Communication with insurance agents and beneficiaries

- Claim file and record management of insurance policies in database systems

- Policy coverage and payout claim amount evaluation

What are the benefits of outsourcing insurance claims processes?

Outsourcing your insurance claims process can be a difficult decision to make. Ultimately, the purpose is to provide a better solution for addressing and processing different claims each day. Insurance carriers can take advantage of the following benefits of outsourcing their claims process:

Cost Savings

One of the most common benefits that insurance company owners seek is cost reduction. Insurance claims processing is a financially challenging task that requires considerable investments in technology, infrastructure, and manpower. Seeking the help of a third-party provider can help reduce costs in recruitment, hiring, training, and the acquisition of new technology and equipment.

Moreover, your company can deliver timely outputs even during peak periods when natural calamities and health-related crises are rampant (Covid-19 pandemic, for example). Letting your service provider hire insurance professionals and experts who can give quality services to your clients can help you save costs and minimize the compliance burden associated with hiring an in-house team to do the work.

Improved Customer Experience

Clients always expect the best experience in any type of service a company offers. Since BPO companies are known for hiring experts and professionals, each staff member is capable of handling different types of back-office issues involving customer service and support. Matched with advanced technology and software, every step of the insurance claims process will be smooth and convenient for both clients and agents.

Technological Edge

When you have the latest technology, you have an advantage over your competitors. Outsourcing insurance claims handling eliminates the need to buy the latest equipment and software for efficient claims management. All important information will be stored using security measures accessible only to insurance professionals.

Insurance verification and billing are just two of the most common insurance claims-handling tasks that can be improved by using Insuretech.

24/7 Support

Most outsourcing companies hire staff and assign them to various work schedules and shifts, enabling them to assist clients in different locations and time zones. Outsourcing insurance claims processing helps you connect with clients and address their concerns 24/7, while reducing manpower and utility costs.

Scalability

Company growth is faster when business owners embrace innovation. For insurance providers, scalability may become a challenge if they have few in-house staff members doing multiple tasks.

Hiring a third-party service provider will let your in-house staff focus on the core functions of your company. This could also mean that you can create a more comprehensive plan to increase company revenue or expand the company’s size through growth or diversification.

Process Flow Improvement

An increase in workload also means an increased demand for workers. Since your service provider is responsible for the recruitment, selection, and hiring process, you can add more claims processors to keep up with the influx of inquiries and claims requests. By doing so, you can improve the entire claims process flow without exhausting your resources.

What insurance claim processing roles can be outsourced?

With the help of your service provider, you can outsource the following positions:

- Customer Service Representative / Customer Support Agent

- Claims Processor / Claims Analyst

- Data Entry Clerk / Encoder

- Recruitment Specialist / HR Specialist

- Underwriting Support Specialist

Important things to look for in an insurance BPO provider

Just like any outsourcing provider, taking the following factors into consideration can lead you to the right partner for your insurance outsourcing journey:

Excellent data security practices

Insurance companies deal with massive amounts of policyholders’ information. Finding a reliable company that offers exceptional data privacy and security protocols is crucial in maintaining a trustworthy relationship with your clients. Stringent data security practices not only minimize risks and challenges for the health and life insurance industry. It also gives insurance companies and insurers peace of mind.

Proven track record in business process outsourcing

Outsourcing allows insurance businesses to optimize their operations while reducing costs. To do this, a proven track record and experience in the BPO industry are a must. A competent outsourcing partner has high service standards and can adapt to changing trends in insurance and in other sectors. Review the company’s growth and performance over a specific period to determine if they can help insurers settle claims efficiently.

You may also want to consider exploring their website to give you an idea of their claims management services. Moreover, you can look for client and partner testimonials to see if customer satisfaction is high. By doing these, you can assess whether it is the right insurance BPO partner for you.

Expert support from skilled and trained staff

Insurance claims processing isn’t as easy as it sounds. In fact, complex cases require certain levels of expertise from a claims processing team. To meet expectations and requirements and guarantee prompt and reliable service delivery, skilled and trained staff are needed. A claims processing team equipped with the necessary skills can improve operational efficiency. Knowledgeable staff can also assess contractual obligations better.

Communicate with your potential insurance outsourcing partner about the key performance indicators (KPIs) that they implement to assess and evaluate performance quality. Insurance BPO outcomes are measured using metrics like loss ratios, combined ratios, and average cost per claim.

Proper technological implementation

When your service provider has advanced technologies and software, outsourcing can help facilitate a more efficient insurance claims management process. Insurance BPO companies typically adopt technological practices, which may involve AI and analytics, to provide better and more prompt claims resolution services to insurers.

Moreover, the right use of technology can lead to significant improvements in client satisfaction levels and operational efficiency.

Cost-effective services

It’s no longer a surprise that insurance companies like to outsource their business functions to cut costs. Apart from better focus on core operations, you will no longer have to worry about the expenses associated with recruitment and labor.

Partnering with a budget-friendly insurance BPO provider allows you to allocate more funds to other key business activities, boosting profitability.

Adherence to compliance requirements

Choosing a reputable BPO for onshore or offshore insurance outsourcing that meets compliance requirements is essential. Outsourcing your insurance claims handling involves the processing of important client data. So, your service provider should be equipped with the right certifications that will guarantee data protection and privacy.

Most BPO companies worldwide aim to acquire ISO certifications to protect the welfare of the company, employees, and clients. Specifically, the ISO/IEC 27001 aims to protect critical data by outlining the best practices needed in the establishment and maintenance of an Information Security Management System (ISMS).

Take your claims processing services to another level. Outsource to Digital Minds BPO.

Insurance is a must-have for everyone, most especially business owners and working individuals. In these challenging times, prioritizing inclusive policies to protect the health, property, and assets of companies and professionals is essential. Insurance companies should transition from traditional claims processing to modern technology for better service to policyholders.

Outsourcing insurance claims can reduce costs and let your team focus on essential activities while handling varying claims demands.

Digital Minds BPO provides various services to help you build a strong client base and establish yourself as a reputable policy provider. Our agents are knowledgeable and friendly, so you don’t have to worry about building and maintaining relationships with your clients. Improve your back-office operations and connect with your clients at a fraction of the cost. Contact us today and let’s start building your dreams!