Payroll management plays a pivotal role in the success of every organization. Handling payroll efficiently is a proven and effective way to ensure employee satisfaction. However, it is also a known fact that the payroll process can be very time-consuming. This leads to businesses tapping into the help of payroll outsourcing companies. Payroll companies manage payroll processes, prevent errors, and enhance payroll operations.

Companies outsource payroll for a variety of reasons, and we will discuss them in this article. Most importantly, we will give you a detailed list of payroll outsourcing statistics and trends that will define 2025. Discover how payroll outsourcing services can help you achieve all your business needs. Let’s dive into the world of outsourcing payroll solutions, its benefits, and its future. Read more.

How does payroll outsourcing work?

Payroll outsourcing involves hiring an external service provider to handle payroll tasks and manage payroll software. Businesses outsource payroll to save costs and access experienced experts, making the process easier.

Business Process Outsourcing (BPO) companies often work as payroll outsourcing providers. BPO firms provide crucial support to businesses by managing their HR and payroll functions. The expertise of payroll professionals, matched with advanced technologies, helps resolve the complexities of payroll processes.

A closer look at the major advantages of outsourcing payroll services

Reputable payroll providers offer plenty of benefits to businesses. Companies outsource their payroll primarily to reduce costs, work with seasoned industry professionals, save time, and have access to scalable payroll solutions. With help from experienced professionals, businesses can minimize or completely resolve payroll errors, which could lead to employee complaints and, worst, high turnover rates.

As a highly inclusive business practice, BPO is in charge of all expenses associated with payroll management and processing. This means that outsourcing services like payroll and bookkeeping can significantly reduce operating costs. Maintaining an in-house payroll team can be very costly, so having a reliable external team is a practical move. In fact, studies show that companies that outsource their payroll operations could save up to 35%.

A National Association of Professional Employer Organizations survey found that 57% of businesses believe outsourcing helps them focus on core activities.

Help your business grow with these helpful payroll outsourcing statistics and trends to know in 2025.

Status of the global payroll outsourcing market size

1. The payroll outsourcing market size is expected to grow by $6.15 billion by 2025.

According to the latest payroll outsourcing market reports, the growth of the payroll services outsourcing industry is due to increased demand. Companies that outsource payroll processing services prioritize time, expertise, and peace of mind in choosing an external payroll service provider.

2. The global payroll outsourcing market grew from 17% of businesses to 38% between 2015 and 2019.

One of the biggest surges in payroll outsourcing demand took place between 2015 and 2019. The growth of payroll outsourcing, despite several challenges, encouraged businesses to adopt the practice internationally.

Payroll outsourcing services and their impact on employee satisfaction.

3. 49% of employees leave their companies after two payroll errors.

Payroll administration is not an easy task. But it doesn’t mean that companies should set aside efficient payroll delivery. A remarkable majority of employees reported that payroll discrepancies could drive them to resign from their current positions.

4. 25% of employees revealed that they have received paychecks with errors.

Opting for payroll outsourcing might be the perfect move for a business. While 25% might seem too few for some, it represents a company’s need to reformat its processes. Intricate payroll procedures are considerably difficult to manage. So, outsourcing this function could offer your processes better accuracy, which will benefit the organization and its employees.

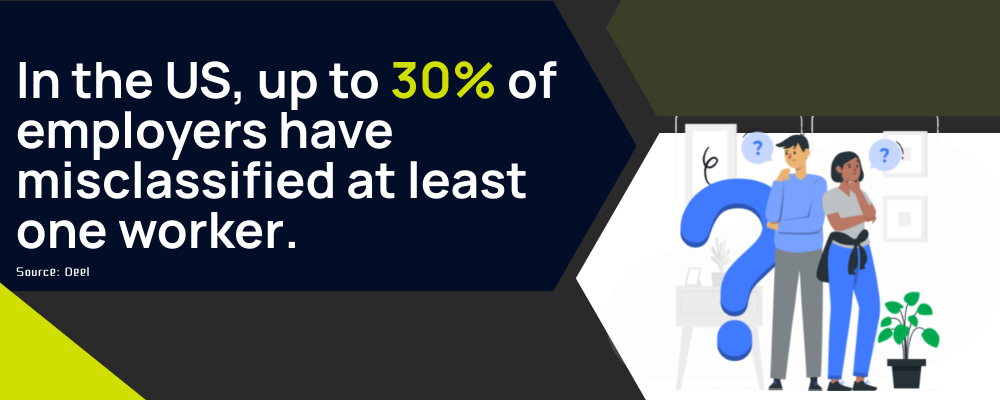

5. 10% to 20% of employees are misclassified by their companies.

Payroll statistics in 2024 reported misclassification as one of the top mistakes that companies make. While it doesn’t seem like a big deal, these mistakes in payroll data can cost a LOT. In 2020, the IRS collected over $6 billion in payroll mistakes alone.

Spotlight on companies that outsource payroll services

6. Mid-sized to large companies tend to outsource their payroll functions more than small businesses.

The latest market research reveals that companies with over 50 employees have a 66% chance of outsourcing their payroll functions compared to small businesses.

7. About one-third of small businesses reported spending more than six hours per month on payroll processing.

HR-related tasks like payroll processing can be extremely time-consuming for large companies. But that doesn’t mean small business payroll is easier to manage. Research shows that many businesses spend a significant amount of time managing payroll.

Payroll outsourcing market segments (based on location)

Here are the top three regions that rely on external providers for payroll management:

8. 39% of US companies outsource their payroll functions.

North America leads the list of regions with companies that rely heavily on outsourcing partners for their payroll tasks. According to the American Payroll Association, over 10 million companies in the U.S. outsource their payroll activities.

9. 61% of European companies outsource partial or complete payroll processes.

A Deloitte study shows that Germany and the United Kingdom are the top European countries driving global payroll outsourcing.

10. Asia-Pacific countries like China, India, and the Philippines became more open to the transformation of payroll processes through outsourcing.

The recent payroll outsourcing market analysis shows that countries like the Philippines don’t just adopt the practice of outsourcing payroll. Most BPO companies in the Philippines are quickly emerging as top reliable providers of payroll services in the world.

ADP remains on top of the most trusted HR management software and services providers.

Automatic Data Processing Inc. (ADP) is still the major player among companies operating in the payroll outsourcing industry. ADP offers payroll management, tax, and benefits administration solutions. Other leaders include the following companies:

Paychex

Based in Rochester, New York, this company specializes in integrated human capital management solutions. Paychex is ranked 681st on the Fortune 500 list of largest corporations by revenue. The company offers advanced payroll solutions and benefits administration strategies to lead businesses to success.

Ceridian

In 2022, Ceridian was named a Leader in the 2022 Gartner® Magic Quadrant™ for Cloud. Specializing in cloud-based HCM platforms, Ceridian provides payroll outsourcing the accuracy, promptness, and safety that it needs.

Workday

The California-based company is a top provider of financial management, human capital management, and student information systems. In 2024, Workday won the Best Company Compensation and Best Company Culture awards.

Important trends in the payroll outsourcing industry

Here are payroll outsourcing trends to watch for in 2025, including collaborations and innovative solutions for market growth.

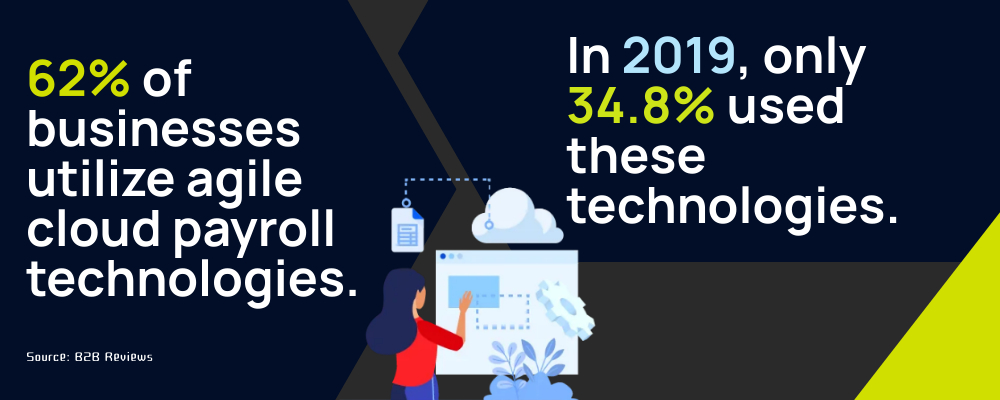

The rise of cloud-based payroll solutions.

Offering a fast, convenient, and safe channel for businesses, the demand for cloud-based payroll solutions continues to increase. Companies are in need of quick, convenient, and secure systems to access important payroll data. This also saves businesses from the hassle brought by bulky payroll systems. Adoption of cloud-based payroll solutions also minimizes the risk of cybersecurity threats and issues.

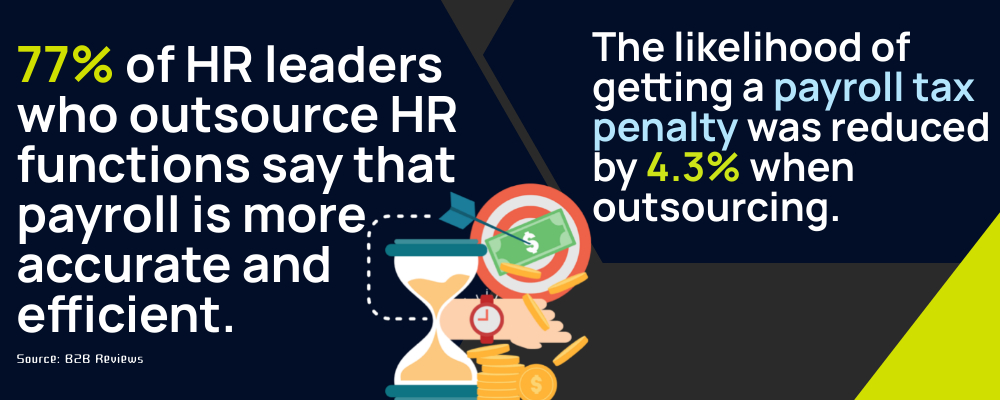

Better focus on compliance and risk management strategies.

One of the most valuable trends in payroll outsourcing, 2025 is predicted as the year of stricter compliance. Payroll outsourcing companies will invest in updating and upgrading their certifications to comply with payroll laws. In addition to a better focus on compliance, BPO firms’ risk management practices are predicted to improve. Tax filing and fulfillment, audits, and accreditations will be highly prioritized.

Effective integration of payroll and employee benefits administration.

Payroll outsourcing offers a boost in the efficiency and productivity of in-house teams. In 2025, experts are seeing significant innovations in the payroll outsourcing sector. These innovations include integration of employee benefits administration and other essential functions into payroll systems. It will also not be limited to benefits. Insurance, pensions, and wellness programs can also be integrated into existing payroll systems.

Outsourcing and offshoring as primary aids to skill shortages.

Struggling with hiring seasoned payroll professionals? The global BPO industry anticipates a rise in payroll outsourcing projects as a solution to companies’ problems with staff shortages. This will not only improve the payroll outsourcing market share, but will also help businesses minimize labor and training expenses.

Transition to subscription-based payroll services.

To ultimately reap outsourcing’s cost-saving benefits and scalability, more BPO firms are offering subscription-based and flexible contracts. Pay-as-you-go services are becoming a trend because they help various industries maximize payroll operations without being stuck with long-term contracts.

Emphasis on AI, automation, and data analytics.

AI and automation in payroll continue to make waves globally. The payroll outsourcing market is expected to reach an all-time high, thanks to the benefits of these technological innovations. AI and automation will pave the way to enhanced digital payroll processes that will ensure employee satisfaction. Likewise, data analytics will assist businesses in making informed decisions, minimizing financial risks, and providing hints of future budget needs.

Emergence of Employee Self-Service Portals.

Outsourcing companies are quickly shifting to more refined strategies to improve payroll processes. One of these strategies is the availability of self-service portals for employees. By properly utilizing these portals, employees can view their pay slips, check tax deductions, and update their personal profiles. This will not only help maintain an organized payroll system, but will also reduce HR workloads.

Outsourcing payroll services could be a huge step towards tremendous growth.

In the ever-changing business landscape, maintaining an excellent payroll process is highly beneficial. The availability of flexible working arrangements has successfully encouraged companies to innovate in terms of operations. Thus, on-time and systematic delivery of compensation is a must. By outsourcing your payroll functions, you can save time and money while ensuring high employee satisfaction rates.

For reliable and the most affordable payroll outsourcing solutions, Digital Minds BPO has you covered. We offer an exceptional range of bookkeeping services to give your business a boost in efficiency and productivity. Our client-focused outsourcing services, including bookkeeping, data entry, payroll processing, and tax preparation, will help your business succeed.

Contact us today and let’s discuss how our outsourced teams can make payroll outsourcing easy for you. We always look forward to helping you build your dreams!